International | Jul 24 2007

By Greg Peel

The Chinese economy is basically out of control. While this is good news for global demand, the reality is that the more the Chinese economy accelerates the greater the risk that it becomes a bubble with an ever-diminishing thickness of skin. The further the economy is allowed to expand at the current pace, the harder the landing will be if that bubble bursts. This is not a fact lost on the Chinese government.

But the Chinese government doesn’t want to halt economic expansion – just rein it in a bit to more manageable levels. It was with that in mind that officials implemented various fiscal and monetary measures during 2006. The idea was to get Chinese economic growth at least below 10%, if not 9%. In accordance, analysts forecasted that this would indeed happen.

Analysts presently forecast that China will grow by 10.5% in 2007 and 9.9% in 2008. That’s a bit higher than the numbers were set at last year, but with second quarter growth coming in at 11.9% when contraction was anticipated its hard to see these forecasts not being revised. On the weekend China raised interest rates by 27 basis points, but it really didn’t achieve much.

Apart from anything else, Chinese officials are concerned about an overheating stock market. Foreign analysts will tell you that the local market could run further still before catching up to global forward PE multiples, but the fact is the recent surge has been led by first-time, middle class investors with no experience of trading and a good deal of faith in luck. If the anecdotal evidence is true, everyone from professionals to cleaners are putting every cent they can lay their hands on into the volatile market, noting that it seems to go basically up. If the market were to have a really serious pullback (and it wouldn’t be the first time) it could be a very painful result for middle class China.

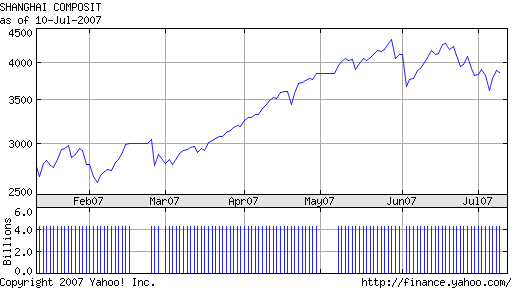

As the above chart shows, there have been four reasonable pullbacks so far this year. The first, in February, occurred when the government contemplated introducing a 20% capital gains tax. This was the move that set the world into a spin, and sparked the subprime mortgage crisis. The second, in March, was following a 27bps interest rate hike. This time the world was more circumspect. The third, at the end of May, came about when the government increased stamp duty. By now the world was ambivalent. The last, more protracted fall occurred over the past month as expectations of another interest rate rise intensified. This came to an abrupt end when China announced 11.9% growth. The Dow hit 14,000.

As soon as the economic growth figure was released, it was immediately expected China would raise that weekend and so it did. Did the stock market blink? No. It ran a good 3% the day before and 3% the day after. Despite the fact that the Shanghai Composite is yet to post new highs this time around, it would seem that one interest rate hike is no longer going to be enough to curb Chinese investment exuberance.

So what is?

There are few analysts who do not expect at least one, if not two more rate rises before year’s end. Indeed, Commonwealth Research, for one, noted that a 54bps rise last weekend would have signalled a more serious tone from the government. Inflation is now running at 4.4%, yet the deposit rate has only advanced to 3.33% and hence real rates are negative. Why wouldn’t you put your money in the stock market?

The government made another move on the weekend, and that was to drop the tax on bank deposit interest from 20% to 5%. There is no capital gains tax on stock market investment (February put paid to that). Clearly China is moving very slowly towards fiscal and monetary policy changes and reforms that are intended to ease, but not stymie, growth in the economy and a stock market bubble. But the economy and the stock market are so far winning the race.

Economists point out that the all-important Seventeenth Communist Party Congress must occur some time around October. They are not expecting any further policy changes to be enacted before then, so that leaves another quarter of strong growth to pass by before the next move is made. It is, however, possible that the next quarter will show a slightly slower pace of growth given the rush to export goods before the end of June when export tax changes were enacted.

The other looming deadline is the Beijing Olympics. After the Sydney Olympics, an extensive hangover set in as all previously fervent activity stopped dead. What will happen in China?