International | Aug 27 2007

By Chris Shaw

According to BIS Shrapnel the outlook for the Asian construction industry is for further increases in activity over the next few years as most countries in the region are in the upturn stages of their respective building investment cycles.

These findings are contained in the group’s “Building and Construction in Asia 2006/07-2011” report, released today.

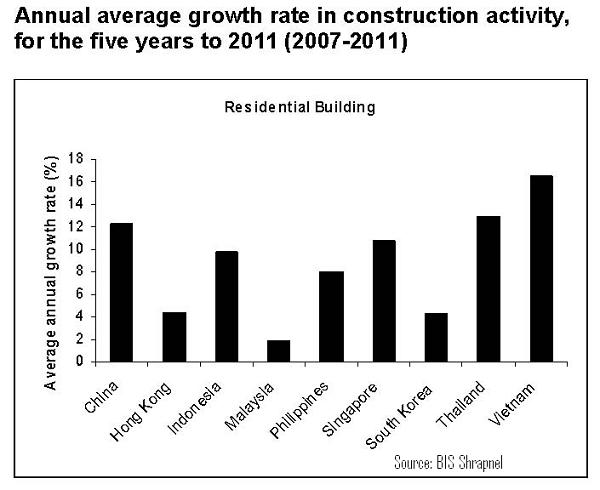

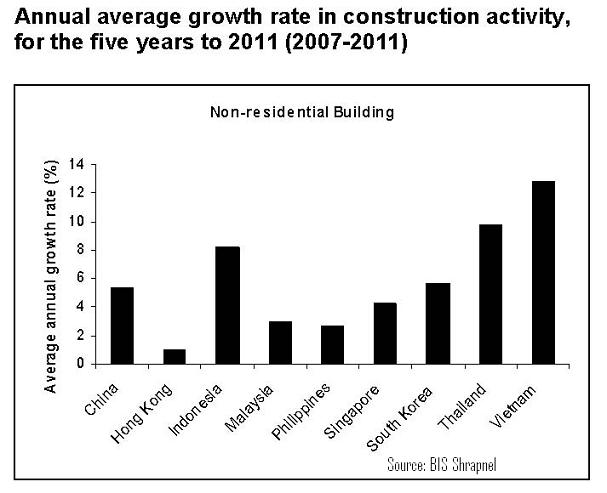

In the report BIS suggests activity is likely to be strongest in China, Vietnam and Singapore as these countries are enjoying increased levels of activity in their residential building sectors.

In China specifically the group expects additional foreign investment to flood in thanks to an increasingly transparent marketplace, which bodes well for construction levels as activity is now spilling over into the next tier of Chinese cities rather than being concentrated in the major regions in and around Beijing and Shanghai.

At the same time increases in infrastructure activity will be supportive for overall activity levels in the group’s view, particularly in the Western parts of the country where a national transportation system is being fast-tracked.

Closer integration between cities such as Shenzhen and Guangzhou on the mainland and Hong Kong are also providing a boost, while on BIS estimates a further 400 million Chinese will migrate to urban regions in the next 10 years, forcing up demand in all sectors of the market.

In terms of the office sector the group expects a continuation of recent tight vacancy rates for higher grade office buildings thanks to the increased foreign investment creating additional demand for space, with Shanghai in particular likely to benefit given the lead-up to World Expo 2010.

This sets the scene for the construction of an additional 16-17 million square metres of office space annually through to 2011, up from 15 million square metres annually in the five years to the end of 2006.

Residential activity will also be strong given the ongoing migration to urban regions, the group estimating 870 million square metres of new residential building will be constructed each year for the next five years, an amount almost double the 490 million square metres of the past five years.

Retail construction space will also rise thanks to the aggressive expansion policy of international retailers in particular, which sets the scene for this sector to record annual increases of 90 million square metres, which compares to the 70 million in annual increases for 2001-2006.