International | May 13 2009

By Chris Shaw

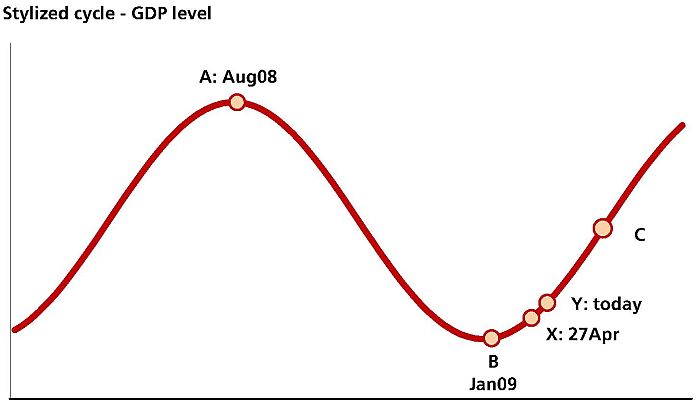

Introduced a couple of weeks ago, the DBS Group Dashboard is a two-dial gauge measuring where Asia sits in the economic cycle, with the latest data relative to the Dashboard offering more good news as they show the region has moved further up the cyclical curve in the past couple of weeks.

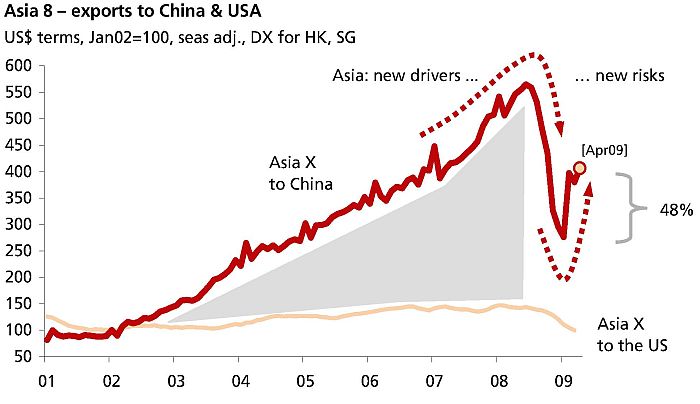

DBS notes those nations that traditionally lag in terms of the timing of data releases, which include the likes of Hong Kong, India, Malaysia and Indonesia, reported export data for March confirming the small correction in that measure in the region in March was simply that, a minor correction.

As well, early bird reporters such as Taiwan and Korea have also delivered solid export outcomes for April, with both up 4% and Taiwan’s exports to China for the month jumping by 7%. The latter is significant as it was exports to China that originally collapsed, pushing down the entire region, but the latest data support a “V” shaped recovery in DBS’s view.

Supply side numbers were similarly positive, with March industrial production (IP) up 5% in Korea and 2.5% in Thailand. Adding in other data the analysts suggest the region-wide advance in IP recorded in February has extended into March.

Given the improvement in both IP and exports DBS suggests it is increasingly safe to say the Asian economy bottomed around January of this year, with the improvement shown since then expected to continue. In terms of actual numbers, DBS estimates Asia-9 GDP fell by 3-4% in the March quarter, but an improvement to growth of 4-5% is expected for the June quarter.

This growth should solidify in the second half of the calendar year as the fiscal stimulus measures offered in many economies around the world begin to take hold.

In graphical terms DBS suggests Asia is now at point Y on the GDP curve, up from point X on April 27th (see first chart above). Readers reading this story through a third party channel may not be able to see the charts included in this story.