International | May 02 2008

By Rudi Filapek-Vandyck

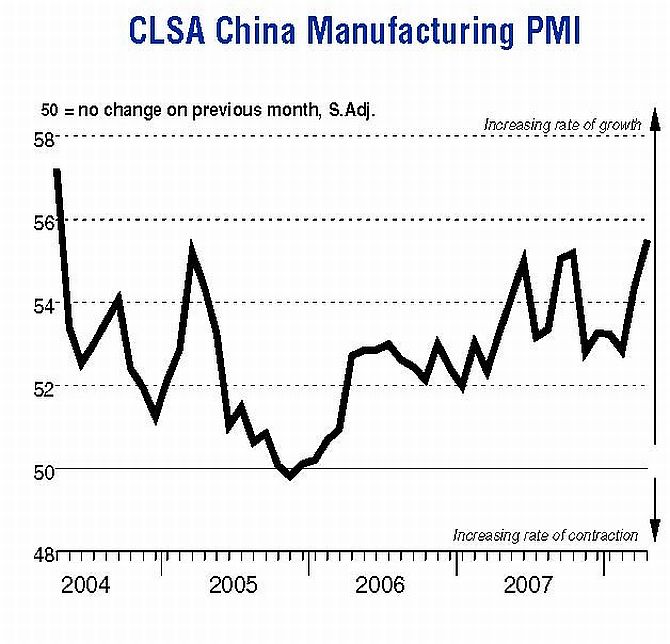

Chinese manufacturers have swiftly overcome the challenges of the first quarter and are enjoying rapid improvements in overall operation conditions. That is the picture that has emerged from CLSA’s latest survey into the Chinese manufacturing economy.

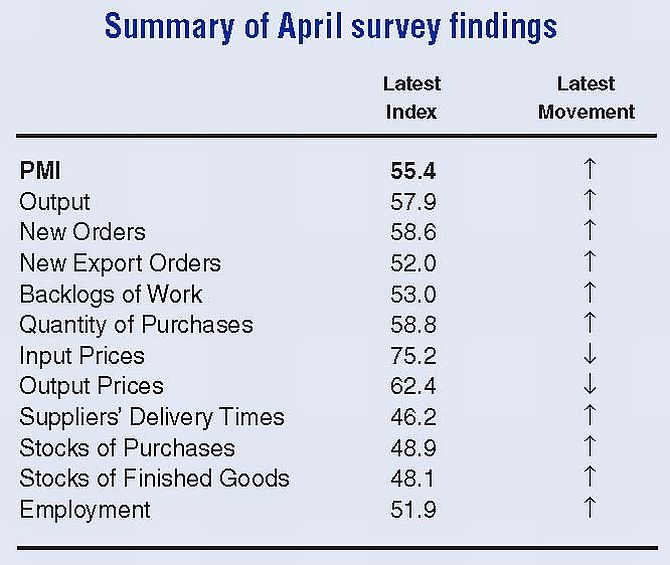

CLSA reports its April survey revealed output and new order growth have accelerated to six-month highs, and firms recruited staff at the strongest pace since last September. Input and output price inflation moderated from March’s survey-record rates though remained elevated.

Eric Fishwick, Head of Economic Research at CLSA, is quoted in the press release as follows:

“Strength was evident across the board in April. New orders jumped (export but especially domestic) as did output. While there is understandable concern that the weakness in the US economy will negatively impact China, there is no evidence of it yet in these data: the PMI shows that manufacturing activity has strengthened into the second quarter. It is costs and inflation that remain the biggest challenge for Chinese businesses. Input and output prices both remain on a steep upward trend.”

The headline CLSA China Purchasing Managers’ Index – a composite index designed to give a single-figure snapshot of manufacturing operating conditions – rose from 54.4 in March to 55.4 in April, its highest level since April 2004. The index reading signaled a robust improvement in the health of the sector, according to CLSA.

Manufacturers expanded production at their plants at a sharper rate in April, reflecting stronger new order growth and the launch of new products. Growth of incoming new business to Chinese manufacturers was bolstered by firm demand, especially in domestic markets. The pace of increase of new work from abroad picked up from March, but nevertheless remained well below that of total new business, CLSA economists report.

In addition, rising production requirements led firms to recruit additional staff for a second consecutive month in April, albeit at only a moderate rate. There were also some reports of planned company expansions leading to the rise in staffing levels, CLSA reports. A solid rise in volumes of incoming new business placed further pressure on firms’ capacity, as unfinished business accumulated at the strongest rate for ten months.

CLSA further reports Chinese firms stepped up their purchasing of raw materials and semi-manufactured goods in April, in response to rising production requirements. Despite strong input buying activity, stocks of purchases fell for the ninth consecutive month, albeit at only a moderate rate. Increased production and supply side delays were linked to the reduction. Post-production inventories also declined, as companies met some of the higher demand for their products by depleting stocks of finished goods.

As far as Inflationary pressures are concerned, CLSA’s monthly survey revealed these pressures have eased from the previous month’s survey-record highs, but nevertheless remained marked. Firms indicated that supply shortages continued to drive up global commodity prices. There were reports of higher prices for a range of inputs, including energy, steel, iron ore and chemicals.

CLSA points out Chinese manufacturers continued to raise factory gate prices at a considerable pace in April in order to pass on higher average costs to customers.